Will you be able to legally avoid paying up to 90% of your tax debt?

You can find out by giving us a call - a company with a BBB A+ Rating

Take the 59sec Tax Savings Calculator Now to Find Out:

Verified Client Results:

100% US-Based Staff

Proudly Serving Vancouver, and All of Washington

Here's How the Process Works:

Free Initial Consultation and Financial Analysis

15 Minutes - We will go through your entire financial situation, step-by-step and see what programs you qualify for, determine how we can help, and answer any questions that you may have.

Research & Investigation

4-7 Days - Using the Power of Attorney, we will work with the IRS to determine what evidence they have against you (without disclosing anything), so we can create a plan of attack.

Fight for the Best Resolution

1-3 Months - After learning exactly what they have against you, we will negotiate with the IRS on your behalf, removing all the penalties we can, and fighting for a great settlement for you.

FREEDOM!

Forever - Once your tax burdens have been lifted, you can go on living your life again! You will finally be free of the burdens chasing you, and can start fresh with no tax debt!

Making tax problems in Vancouver a thing of the past

Highly Experienced Vancouver Tax Lawyer

Among the key issues that most Vancouver citizens run into in terms of IRS back taxes is feeling stressed and overwhelmed concerning the money they owe. With the IRS sending threatening letters and notices, revenue officers, and even taking away money, property and assets, it could be a very chilling experience.

We believe that no one should have to go up against the IRS alone.

It’s simply not fair what they put regular tax payers through, and we consider they shouldn’t get away with it any longer.

That means you do not pay a penny for the total use of our experienced team for a full week.

That’s on the very top of our no questions asked 30 Day Money Back Guarantee.

What are you looking forward to? The longer that you put it off and wait, the more fees and interest costs the IRS will tack on to the amount that you just owe. Take actions and call our Vancouver team a call today to get started!

Give our office a call today!

Say goodbye for good to your IRS back tax returns by using a capable Vancouver law firm

Have you ever been struggling for several years with your back tax debts, and are finally fed up with dealing with the Internal Revenue Service on your own?

Have they started sending letters and notices to your residence or company, demanding you pay interest costs and additional fees for the sum you owe?

If so, the best thing yo ulna do is hire a tax law business that is reputable and experienced to be by your side each step of the way. The good news is, our Vancouver firm is an ideal candidate for the job, with an A+ business rating with all the BBB, tens of thousands of satisfied customers throughout the country (notably in amazing Washington), and our own team of tax attorneys, CPAs and federally enrolled agents, all prepared to work on your case today.

The IRS is the largest collection agency on the planet, with a large number of billions and revenue officers of dollars set aside to pursue great, hard working folks like you for the money you owe. The only thing they care about is getting the money they are owed. You should not have to confront them by yourself. We don’t get bullied around like regular citizens do, and can use our private contacts to negotiate the settlement that you need.

Using seasoned Vancouver legal counsel on your own tax issues is like having an expert plumber come and repair your massively leaking water main. Sure you could probably eventually learn how exactly to repair it by yourself, but by the time you do, your home is most likely permanently damaged from leaking, and certainly will cost a lot more than simply hiring the specialist in the first place.

Our team of experts is standing by, prepared to help you!

Has the IRS been sending Revenue Officers to your Washington dwelling or business?

What is an IRS Revenue official?

Agent or an IRS officer is an average visitor to your Washington business or daily life. Getting a distinction between the two is very important for you to understand how to cope with each. An IRS representative has the primary function of auditing tax returns. They send notifications regarding forthcoming audits via e-mail. You can either go to local IRS office once you get an e-mail from IRS agent or an agent comes over to your home or company to audit returns.

The IRS assigns you a revenue officer in the following circumstances:

Inability to Gather Tax Payments

When the IRS has failed to successfully collect taxes from you using the ordinary channels like notices, levies, telephone calls and emails.

Un-Filed Taxes

Like payroll taxes, when you neglect to pay certain type of taxes.<?p>

Large Tax Debts Owed

A standard figure being 25,000 dollars or more., when your tax liability is significantly large

Recall IRS revenue officers are mandated by law to undertake measures to regain the taxes. These measures may include issue levies, seize and repossess property, halt assets or wage garnishments. Expect these officers to show up at your residence or area of businesses unanticipated or without previous communication. In infrequent cases, the policemen might call you or send you emails summoning you to their offices. Attempt to cooperate with them to avoid further complicating your case and try to pay you over-due taxes to the expand your income can accommodate. In case your case is more complicated or the tax amount requires you to workout a plan to pay, you’ll need the professional services of an attorney.

What To Do if you Get {a Revenue Officer|an IRS Revenue Officer

If you are not able to settle your debt immediately, the Internal Revenue Service officer might request some documents and financial records. Such information like form 9297 which is send to you by the IRS, form 433-A which is used for people or form 433-B which is used for companies are used by the Internal Revenue Service to recognize your income, assets, and give a summary of your liabilities. Filling these forms ought to be done correctly and precisely therefore the services of an attorney are needed. Consequently, when you get these forms, the very first thing to do would be to telephone legal counsel.

Also, an attorney in Vancouver will review your financial situation and work out the best paying strategy with the IRS revenue officers. Without legal counsel, you might intimidate into agreeing to a strategy that you cannot afford but which makes their job easier. An attorney is able to certainly negotiate and get you a adaptive one if you are given tight datelines. Remember, there are lots of choices that can be offered by the officer. A common one in case linked to payroll overdue will be to assess and assign you a recovery fee trust fund. For this to occur, an interview should be run to discover who’s the actual culprit between an individual and also a company and having an attorney during this interview in Washington is a matter of necessity.

An Offer in Compromise arrangement could save you up to 90% on your back tax debts owed

What is it

The client faced with serious tax problems by paying or instead bailing them out up to less than the sum owed is helped by the Internal Revenue Service. Nevertheless, not all taxpayers that are troubled qualify for IRS Offer in Compromise Deal. This is entirely because qualification relies on several factors after evaluation of the customer was carried out. The IRS Offer in Compromise Agreement plays an instrumental role in aiding taxpayers with fiscal challenges that are distressed solve their tax problems. What this means is the IRS functions as the intermediary that helps their tax debt is paid by the citizen in the handiest and adaptable manner.

What Does it Take to Qualify?

Filling the applications doesn’t guarantee the Vancouver citizen a direct qualification. Instead, the IRS starts the entire assessment and evaluation procedure that could leave you incapable of settling your taxes. These programs are then supported with other important records which will be used by the Internal Revenue Service to determine the qualification of the taxpayer for an Offer in Compromise Deal. However, there are some of the few qualifications procedure that must be satisfied completely be the taxpayer. All these are the three fundamental tenets of qualification that each taxpayer must meet in order to be considered.

What to Do Next

This is a fantastic law firm that can serve as a yard stick for individuals who require help that is proper in negotiating for an IRS offer in compromise arrangement. Don’t hesitate to contact them because they have a good safety reputation and a powerful portfolio. They have a team of dynamic and capable professionals that are always on hand to help you. Try them now and experience help like never before. It’s just the finest when it comes to dialogue of an IRS offer in compromise arrangement.

Do not get conned by a tax relief business with no track record - call our BBB A rated business now.

Most people are law-abiding Vancouver citizens and they dread the dangers of IRS actions. Seeing this as a great chance, plenty of tax resolution businesses out there set out like vultures circling on these weakened preys. These companies entice innocent individuals into their scams and commit even and consumer fraud theft! Thus, care should be exercised by you when you’re attempting to locate a tax resolution company for yourself.

What Scammy Companies can do

Not all Washington tax relief businesses who promise to negotiate together with the IRS for you are trustworthy. Because there are all those deceitful businesses out there, thus, preventing IRS tax relief scams is vitally significant. It is not impossible to prevent being taken advantage of, all you need to do would be to educate yourself in this respect and to follow a number of useful tips! First things first, never pay in total upfront whether the tax resolution company asks for it in the beginning or in an obscure manner at some point of time. A tax resolution company that is genuine will always folow a mutually satisfactory financial arrangement wherein the payments could be made on a weekly, bi-weekly or monthly basis.

Secondly, it is best to be very attentive when you are selecting a specific tax resolution firm to work with. Chances are the company is deceptive should they promise you the desired outcomes or state that you simply qualify for any IRS program without going through a complete fiscal analysis of your current situation then. After all, it’s not possible for companies to pass such judgment without going through your complete financial investigation first. So, don’t fall for their sugar-coated promises and search for other genuine firms instead.

How to find out about a company

The internet is a storehouse of information, but you must be cautious about using such information. For handling your tax related issues, do not just hire any random business with good advertisements or promotional efforts. To be able to pick the right company, it is advisable to study about the same in the Better Business Bureau website and see their ratings or reviews. So, doing your homework and investing time in research is certainly a sensible move here.

A website with a great evaluation on BBB is definitely one you could place your trust in. We’re a BBB A+ rated Vancouver business, we help people by relieving their IRS back tax debts. Our tax alternatives are reasonable, to be able to make sure that all your tax debts are removed, we don’t merely negotiate on your own behalf with the IRS, but rather develop a practical strategy. We do all the hard work for you while you concentrate on different important facets of your own life. Because of our vast experience and expertise in the field, you may rest assured that your tax problems would be resolved immediately and effectively when you turn for help to us.

Rather than having to pay tax debt at the same time to you all, let our Vancouver team negotiate a payment plan for you

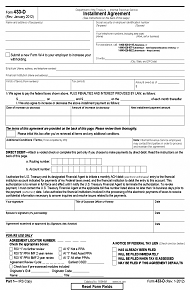

As long as their tax debt is paid by the citizen in full under this Agreement, they avoid the payment of the fee that is connected with creating the Arrangement and can reduce or eliminate the payment of interest and penalties. Creating an IRS Installment Agreement requires that all required tax returns are filed before applying for the Deal. The taxpayer cannot have some unreported income. Individual taxpayers who owe $50,000 or less in combined individual income tax including penalties and receive can interest 72 months the amount of tax owed . If more than $50,00 in tax debts are owed, then the citizen may apply for a longer period to pay the debt.

Good Parts about an Installment Plan

The agreement will result in some significant advantages for the citizen. While an agreement is in effect, enforced set actions WOn’t be taken. Life will be free of IRS letters and notices. When the citizen can count on paying a set payment each month rather than needing to worry about putting lump sum amounts on the tax debt, there’ll be more fiscal freedom. The taxpayer will remove continuing IRS fees and interest. The Internal Revenue Service will help the taxpayer keep the agreement in force in the event the taxpayer defaults on a payment providing the IRS is notified immediately.

Obligations of the Installment Agreement

Some duties include the Installment Agreement. When due, the minimum payment should be made. The income of an individual taxpayer or the incomes of taxpayers that were combined must be disclosed when applying for an Installment Agreement. In some cases, a financial statement should be provided. All future returns should be submitted when due and all the taxes should be paid when due. Citizens paying their tax debt under an Installment Agreement could have to authorize direct debit of their checking account. This way of making monthly payments enable the citizen to request that the lien notice be removed. If the taxpayer defaults on the Installment Agreement, however, the lien can be reinstated.

The citizen can negotiate an Installment Agreement with the IRS. Nevertheless, particular information must be supplied and any advice could be subject to verification. For citizens a financial statement will be required.

How to Get Ready to Apply for an Installment Agreement

There are a few precautions that must be considered while citizens can apply for an IRS Installment Agreement. There are some position which can make this a challenging task though the IRS tries to make applying for an Installment Agreement a relatively easy procedure. Since many problems can be eliminated by an Installment Agreement with the IRS, it is crucial to get it right the first time the application is made.

We’re the BBB A+ rated law firm serving all of Vancouver and Washington, that can provide skilled assistance to you. Our many years of experience working on behalf of citizens who have difficulties paying their tax debt with the IRS qualifies us to ensure approval of your application for an Installment Agreement.

Other Cities Around Vancouver We Serve

| Address | Vancouver Instant Tax Attorney900 Washington St, Vancouver, WA 98660 |

|---|---|

| Phone | (509) 740-3337 |

| Customer Rating | |

| Services / Problems Solved | Removing Wage GarnishmentsGetting Rid of Tax LiensRemoving Bank LeviesFiling Back Tax ReturnsStopping IRS LettersStopping Revenue OfficersSolving IRS Back Tax ProblemsIroning out Payroll Tax IssuesRelief from Past Tax IssuesNegotiating Offer in Compromise AgreementsNegotiating Innocent Spouse Relief ArrangementsPenalty Abatement NegotiationsAssessing Currently Not Collectible ClaimsReal Estate PlanningLegal Advice |

| Tax Lawyers on Staff | Steve Sherer, JD Kelly Gibson, JD Joseph Gibson, JD Lance Brown, JD |

| Cities Around Vancouver We Serve | Amboy, Ariel, Battle Ground, Brush Prairie, Camas, Carrolls, Carson, Castle Rock, Cathlamet, Cougar, Heisson, Kalama, Kelso, Portland, La Center, Longview, North Bonneville, Ridgefield, Ryderwood, Silverlake, Stevenson, Toutle, Vancouver, Washougal, Woodland, Yacolt |